Insight

CAPE: Fear or Good Hope? Part 2

Further analysis of the Schiller CAPE ratio by our CIO David Smith:

I ended Part 1 of our look at the Shiller CAPE ratio with 2 questions: has there been some fundamental change in the market that now justifies higher levels in the ratio? and should we be worried at a current reading of over 37?

Several reasons have been advanced to justify the increase in the level of the ratio in recent times, some of which I find more persuasive than others:

1. The most often cited reason is that modern accounting standards have tended to push the ratio higher. An example, is the treatment of goodwill and asset write-downs where changes to GAAP (Generally Accepted Accounting Principles) since 2000 have pushed stated earnings down (and the CAPE up).

2. Share buybacks are much more common now than historically. They will tend to drive up share prices (though, since they also act to increase earnings by reducing the number of shares in the earning per share denominator, the impact on P/E ratios is less certain in the long-term).

3. Transaction costs have fallen over time, which will tend to justify (slightly) higher stock prices.

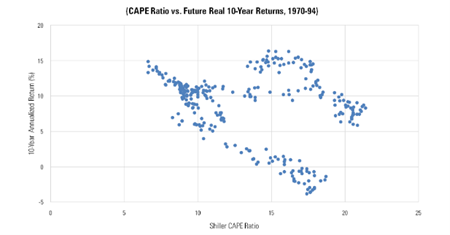

I thought the last justification was worth some further exploration and in the course of my investigations came across a couple of interesting analyses by Michael Finke* and John Rekenthaler** on the web. Finke and Rekenthaler plot the CAPE ratio, month-by-month, against the S&P 500’s subsequent 10-year results expressed as an annualised result, and in real terms. For the period February through December 1994 the plot looks as follows:

Rekenthaler allows the CAPE some credit in that, and as he points out, the “lowest CAPE ratios were reliably followed by good returns” but he otherwise describes it as “useless” and its predictive powers as “nonexistent”. Ken Fisher, a well-known CAPE sceptic, would typically and graphically call this pattern “a shotgun blast on a windy day”.

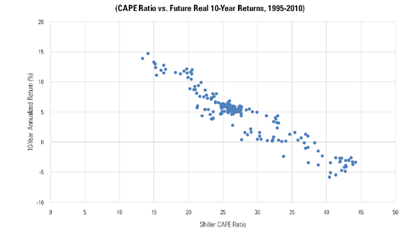

To my mind, and where it starts to get interesting, is what happens when you look at the next 15 years of data. Carrying on the analysis from January 1995 to the Summer of 2010 (the last to allow for 10 years of future earnings data up to the time of the writing of Finke’s article in the Summer of 2020) and plotting the same statistics gives us the following results:

A pretty good correlation in anybody’s books!

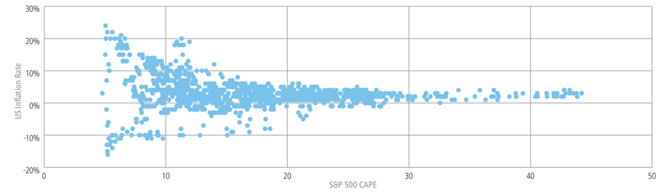

And, of course, one fundamental change affecting markets in the 1990s was the taming of inflation and the transition to a low inflation environment that has persisted ever since. Put simply, it seems that investors are simply prepared to pay more for stocks, and their dividends, when inflation is low, something we can see quite clearly in the following graph of the CAPE ratio against US 1-year inflation rates, month-by-month in the 100 years to the December 2017:

10-Year Rolling S&P 500 CAPE vs 1-Year US Inflation Rate over 100 Years

Note that this graph by Makenzie Investments, using Robert Shiller’s own data, ends in December 2017. The current figure for the CAPE would put it far out on the right-hand side, close to the right axis.

So, I think we are ready perhaps for tentative answers to the 2 questions posed at the end of Part 1 and the beginning of Part 2.

Yes, there are fundamental reasons justifying a higher CAPE ratio now than at any other time in its past: namely, and most tellingly the transition to a low inflation rate environment.

And should we be worried by the CAPE’s current level? – probably not as a guide to the performance of equities in the short and medium term. This is not, after all, the CAPE’s usefulness. But, and on a 10-year view, we should be wary, and particularly so, if it looks like inflation might make a comeback, though that, I fear, might be a subject for another Investment Insight.

* Finke, Michael 2020, ‘The Remarkable Accuracy of CAPE as a Predictor of Returns’, available at Advisorperspectives.com

** Rekenthaler, John 2020, ‘Maybe There’s Something to the Shiller CAPE Ratio after All’, available at Morningstar.com