Insights

Insights

Upcoming UK Election:

What Effect Would A Labour Government Have on UK Markets?

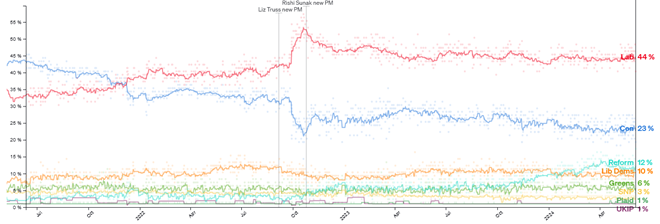

The United Kingdom is less than a month away from a General Election in which, if the polls are to be believed, the fourteen-year long rule of the Conservative Party will be comprehensively ended by Keir Starmer’s Labour Party. Whilst polls always ought to be taken with a pinch of salt, and represent data compiled and processed in different ways by different companies, there have been few meaningful shifts in Labour’s strong lead since Prime Minister Rishi Sunak damply announced the dissolution of Parliament on 22nd May.

Parliament Voting Intention (aggregated polls)

Source: Politico

Thus far financial markets have seemingly shrugged off media excitement, continuing to focus on macroeconomic data like inflation levels and the decisions made on interest rates by the Bank of England.

The Bank was granted independence to set these rates by Gordon Brown, one of the eight Labour men to have ever served as a Chancellor of the Exchequer. Since coming to power in 2010, the Conservatives have seen seven. This illustrates one of the first problems when trying to gauge the impact of any incoming Labour government on UK markets – the fact they do not happen very often. The Tories have held office nearly twice as long as Labour since the start of the twentieth century and approximately 70% of the time since London’s role in modern financialised capitalism was cemented by Margaret Thatcher’s Big Bang reforms of the 80s.

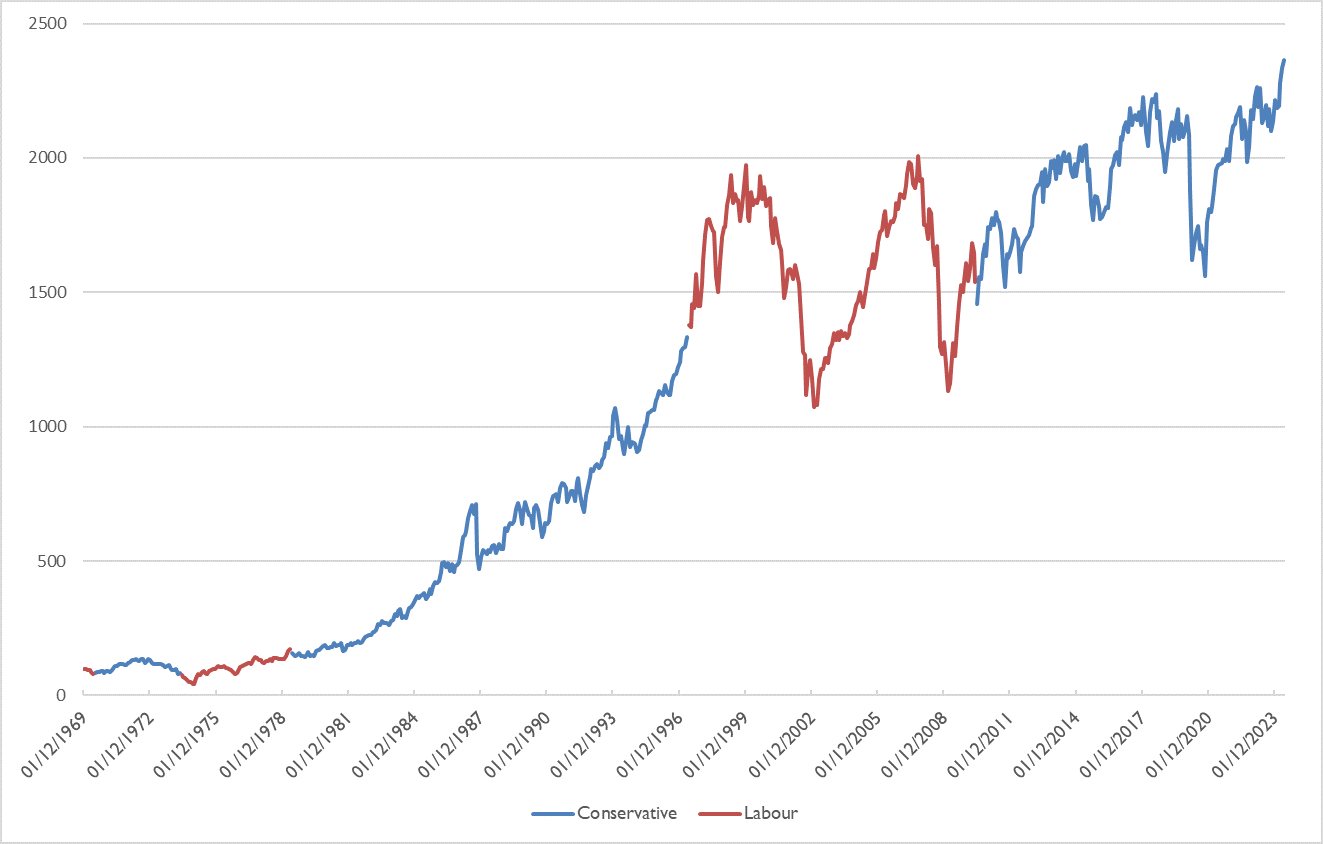

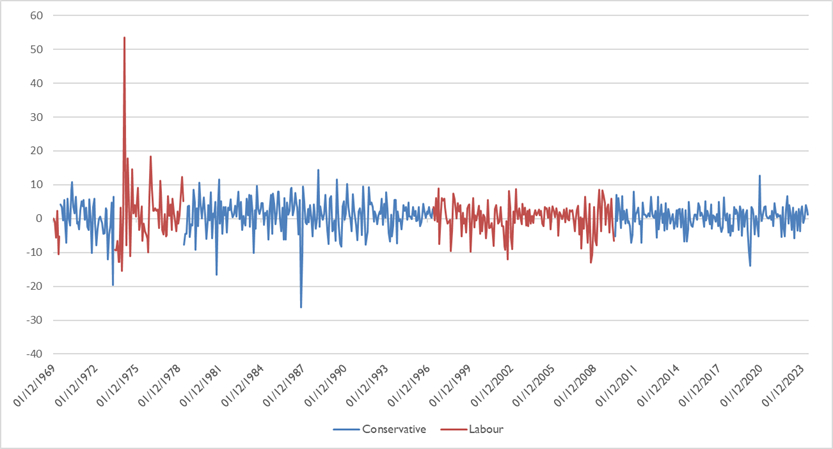

That said, since 1970 the average monthly return for the MSCI UK index has been 0.62%, with Conservative governments averaging 0.69% and Labour 0.49%. If we were to focus on the more comparable data of returns since deregulation in 1983, the Tories would have returned on average 0.71% per month compared to Labour’s average of 0.19% between 1997-2010.

MSCI UK Index by party leading government

source: Bloomberg, MSCI

MSCI UK percentage return by party leading government

source: Bloomberg, MSCI

The charts above illustrate this but show the difficulty in extrapolating conclusions based on relatively short return periods over points of great volatility. When Labour was last in power there were two seismic global stock market events – the Dot Com bubble and the 2008 Great Recession. So what can investors expect?

There has been plenty of economic turbulence in recent years, whether from the 2016 vote to leave the EU, Coronavirus shock of 2020, or the disastrous mini budget in 2022 that led to Liz Truss’ defenestration. Considering the turbulence roiling the Labour Party itself until recently, Starmer and his shadow Chancellor, Rachel Reeves, have promised a period of economic and political stability. Reeves has guaranteed the independence of the Bank of England under a future Labour government (Reeves was once a BoE employee), the 2% inflation target will be maintained, also committed not to raise income tax, corporation tax or national insurance, and signed up to fiscal targets that stipulate government debt must be falling by the fifth year of each forecast.

Reeves’ pledge to stick to current fiscal rules (Gordon Brown pledged similar in 1997) and her reassurance that any significant tax and spending changes will, by law, be subject to independent analysis and forecasts from the Office for Budget Responsibility is an attempt reassure voters and Gilt markets there will be no Trussite self-inflicted yield spike in UK debt. Considering the apparent inevitability of a Labour win and the relative stability in yields since the election was called, they seem to believe her.

In June analysts at JP Morgan said, “we think that this time, a Labour win will likely be seen as a positive for the UK markets … the current Labour party has a much more centrist policy agenda.”

Indeed, the contrast with recent history is stark. A Bloomberg survey conducted in September 2023 showed that 64% of professional investors thought that a clear Labour victory or a Labour-led coalition would be the most “market-friendly” election result (25% opted for a clear Conservative majority). Earlier this month MPs from the party met with global fast fashion giant Shein as it prepared to push for listing on the LSE – which would be the UK’s biggest ever stock market flotation. This moderate agenda combined with a strong majority within Parliament may inspire elevated business and consumer confidence. Confidence could buoy UK equities, which currently sit at around a 45% discount based on 12-month forward price/equity ratios versus their US equivalents. This in turn may cause international managers to re-think asset allocation decisions towards a market that sunk from 7.5% of the MSCI All Countries World Index (ACWI) in 2011 to 3.97% in 2024. Slowing inflation is leading to real wage gains and UK consumers – unlike in many other developed countries – continue to hold elevated levels of savings. There are green shoots of growth and domestic equity markets are beginning to experience some outperformance versus international comparators.

Conclusion

After period of recovery from the financial crash, Brexit, the COVID-19 pandemic and years of internecine Conservative strife, the UK is likely to get a new government with, possibly, one of the largest majorities in Parliament’s history. This government has all the indications of being business-friendly and comfortable introducing reforms to increase productivity and investment. Whilst it is unlikely that Labour will be particularly revolutionary in the short-term, it remains a left-of-centre party ideologically committed to greater government action and acts of public investment.

There will be consequences for individual sectors and industries and despite Keir Starmer’s apparent moderation the size of his win will give him and his government a large degree of power to change policies, regulations, and industrial policy. IAM’s research department and Investment Committee is always working to identify the strongest regional managers and funds able to take advantage of change, in whatever form that may come.