Insights

Putting the investment structure together

A dynamic investment structure should respect risk guidelines, be capable of achieving the investment objectives, delegate a level of decision-making – appropriate for each client – to experts within the structure, draw on the best investment talent out there, develop along with the client’s growing expertise and interest, and express a coherent investment strategy.

My colleague Simon’s note on the need to get the investment structure right at the outset – see earlier in this same feed – started me thinking about some of the other considerations we bear in mind when building a client’s investment structure. This is one of my favourite parts of our role, creating a dynamic structure that: respects the risk guidelines; is capable of achieving the investment objectives; delegates a level of decision-making – appropriate for each client – to experts within the structure; draws on the best investment talent out there, whether working for a traditional investment manager or a fund; can develop along with the client’s growing expertise and interest; and expresses a coherent investment strategy. In some ways, with its emphasis on judgement and tailoring to suit particular circumstances, it is the part of the job that feels to me most like an art and, rather fittingly, comes immediately after the science of setting the guidelines and objectives – more of that, I hope, in a later note.

We start with the investment guidelines. These control the amount of risk to which the structure is exposed and go beyond conventional measures of volatility to consider the whole gamut of different risks affecting portfolios, including liquidity risk, institutional risk, sovereign risk, credit risk etc. Consideration of these risks generates a series of ranges and limits – for the different asset classes, institutional exposures, credit limits, currency exposures, position sizes etc – which, taken together, limit the structure’s total risk whilst, at the same time, defining the opportunity space it can operate within. Our goal then becomes to design a cost-effective and practical structure that is capable of maximising returns within the risk profile established by the guidelines.

The first consideration in designing the structure is deciding how much of the asset allocation dynamic should be delegated to the structure itself and how much should be retained by the client. Typically, the majority of the dynamic is delegated to the structure. Depending usually on the quantum of assets, this is done via segregated accounts with investment managers or via asset allocating funds. Where segregated accounts are employed, we furnish each investment manager with their own set of investment guidelines not only specifying which asset classes are to be used and the ranges to be applied to them but covering substantially the same ground as the total account guidelines.

In this way, we effectively delegate a portion of the risk budget, or opportunity space allowed within the guidelines, to each manager. Of course, and in the interests of proper diversification, we prefer that each manager does something different so that we do not end up with the same perspectives expressed by the same holdings in the same combinations and, to this end, we carefully blend managers, choosing ones who can explore different dynamics (combining, for example, a couple of traditional managers who use the full range of asset classes with one who likes to allocate between just equities and alternatives) and different instruments (think of managers who buy only direct holdings compared to those who buy only best-of-breed funds, not to mention those who mix the two) whilst always playing to their particular strengths and talents. To this end, we maintain, and make available to clients, comprehensive information files, comprising due diligence questionnaires, presentations, brochures, company financials, copies of agreements, fee schedules, quantitative and qualitative analyses, our own summary reports etc on a whole host of investment managers with proven expertise at allocating across asset classes.

Compared to those consultants and advisors relying on conventional index benchmarks or peer groups, we have a tremendous advantage in having developed our own simulations approach and software, AMps (Active Management Performance Standards). The AMps approach not only helps us to set the guidelines and objectives at the total account and individual manager level but also to assess how well the account or individual manager is performing on an ongoing basis. It does this by simulating the performance of a whole universe of randomly generated portfolios each of which meets the constraints and limits of the relevant guidelines and which, together, effectively map out the complete opportunity space available to the portfolio or manager. The result is a massive bespoke peer group against which we can rank the account’s actual performance and which we can use, inter alia, to establish the statistical significance of the result, tease out the impact of stock vs asset selection or look at the results simultaneously over multiple timeframes.

Where clients have the expertise to retain more of the asset allocation decision-making, we trim back the amount given to asset allocating managers and funds in favour of single asset class accounts or funds, all the time respecting the total account guidelines and thus controlling the risk. Our experience is that the more clients participate in the investment decision-making, say through an investment committee or family council, the more they grow in expertise and confidence over time and, as a natural development, want to have more of a say in the asset allocation decision, leading to a gradual reduction in the monies committed to asset-allocating investments and a corresponding increase in other investments. It is thus important, in the first instance, to design a structure that can accommodate this trend.

This then naturally brings us onto the subject of the single asset class accounts or funds used to populate the rest of the structure. Although I refer to segregated accounts and funds, we generally find that the best specialist investment managers invariably offer fund solutions and that these either provide, or can provide, the most cost-effective access to their strategies, albeit often after an element of negotiation. That said, there will be occasions – perhaps because of the scale of a client’s funds or the need to apply a particular restriction to control a client’s risk – when it makes more sense to employ a segregated account.

Where the client accepts a significant portion of the asset allocation decision-making, the segregated accounts and funds will need to cover the traditional asset classes, broken down as appropriate between the different regions and markets but, all the time, using best-of-breed managers.

The rest of the monies is invested in a range of different funds, all designed to add extra investment alpha to the total structure and, including, ones that: fill gaps not properly covered elsewhere in the structure (think small capitalisation companies or private equity, for example); access very skilled managers not available through asset allocating solutions; or tilt the structure in a particular way, either tactically, for the short-term, or for the long-term – many clients, for example, like the idea of using this satellite of funds to give the portfolio a long-term tilt to ESG factors, or particular themes they are interested in like artificial intelligence or robotics. As a general rule, we find this portion of the structure tends to work best where the fund managers are doing something different and interesting compared to more mainstream funds.

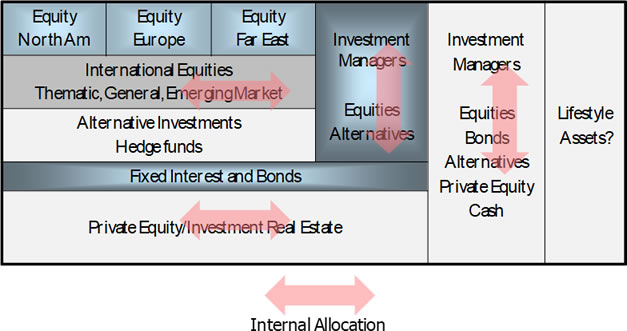

The ultimate goal is to end up with a structure that looks like the following stylised diagram but which is appropriate to the client’s needs and expertise and, which, hopefully is an evolution of what they may already have, rather than a radical (and costly) restructuring:

Here, we have a structure with asset allocating managers exploring different dynamics (equities vs alternatives as against allocating across the whole range of asset classes), funds allocating between different equity markets or between private equity and property, and specialist fixed income, alternatives and regional equity funds. Importantly, the whole account would be subject to, and would respect, the total guidelines, whilst the asset allocating managers would also have their own sets of guidelines each using a portion of the total account’s opportunity set. The structure also allows for the incorporation of lifestyle assets which are often ignored in conventional structures but which may represent a very significant fraction of the total assets (or liabilities).

So there we have it – a dynamic structure capable of responding to its environment, operating at a level appropriate to the client, controlling risk and incorporating the best investment talent out there.