Insights

Getting the investment structure right

The delegation of investment powers should require a fiduciary to go beyond simply choosing who to appoint as their discretionary fund manager and beyond them then employing their preferred choice’s ‘flagship’ ‘medium risk’ strategy.

The challenge in the discharge of their duty - which is to protect and enhance their client’s wealth (maximising net of cost returns at an appropriate level of risk) - is that the key investment decisions and the various risks that subsequently arise from these decisions are often unknowingly being made by them at the outset and have not been effectively delegated away.

At the outset what might seem relatively simple questions to ask in isolation, when combined, lead to a multitude of complex and important considerations. Questions such as, who to use? How many to use? How much to give them each? What jobs do you want them to do? How do you instruct them? Should you/they use individual stock positions or funds? How much should you pay them? How do you ensure they are doing a good job? How do they fit alongside other assets?

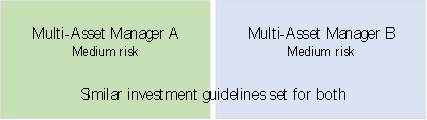

In an attempt to address these questions, we see clients typically appoint 1-2 managers and then employ them under a similar general multi-asset mandate with the same target return objective and a risk profile that is considered to be suitable for the client but which is more often than not placed in the ‘balanced’ bucket as this makes for ease of operation for the fund manager (very few of us are actually ‘balanced’). This type of approach is understandable and tempting as it makes for ease of administration and ongoing performance comparison, but does it really provide the diversification needed? Another issue with this approach is that the typical medium risk mandate will generally operate under relatively tight asset ranges and currency exposure constraints which means the fiduciary is effectively making the asset allocation and currency decisions themselves.

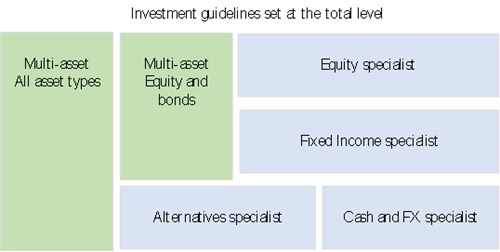

The diversification benefit of employing more than one fund manager is well understood, helping to reduce not only the decision making risk of that one manager underperforming the wider market or failing to meet the objective set but also from issues around institutional risk (think Barings) and key man risk (think Woodford). Less well understood and appreciated however is the need to diversify by investment strategy and style and the increasing importance of employing specialists, which can be strategies in individual asset classes or geographies, sectors, investment themes, ESG etc…, rather than just using generalists. Is any one manager good in all investment areas?

By setting similar or the same mandate instructions to managers, whilst easy for performance comparisons, tends to reallocate funds between them at arguably the wrong times as past performance is often incorrectly rewarded. One should also not be surprised that setting the same mandate leads to similar risk and return outcomes. Most investment teams analyse companies and markets using well established methodologies learnt whilst studying and attaining the same professional qualifications all of which leads to the emergence of the consensus view. In addition, institutional rigidities, such as the focus on their own corporate risk of deviating too far away from the pack, will also restrict effective active management and will lead ultimately to a lack of diversification and the possibility of underperformance.

To avoid this we recommend that at the outset the fiduciary should consider as part of the investment policy statement, a strategic framework which is disciplined by setting appropriate risk controlling investment guidelines for the total portfolio and also for its various component parts (be that managers or individual funds) and which allows for flexibility within these for the use of a combination of multi-asset managers and selective specialist strategies.

IAM Advisory consider that getting the investment structure right at the outset is a key determinant of a successful and dynamic portfolio.