Insights

Inflation and the business cycle

Our Chief Investment Officer, David Smith, considers inflation and the business cycle

With the US Federal Reserve (the ‘Fed’) aggressively raising rates to combat inflation as it hits a 40-year high (and with other central banks poised very much to follow suit), economic growth starting to falter, COVID-induced supply chain dislocations still creating havoc – most recently in China where the authorities are struggling to maintain a zero infection strategy in the face of the highly infectious Omicron variant, and massive disruption to global food and energy supplies caused by the Russian invasion of Ukraine, it is hardly surprising that equity markets have had a torrid time of it so far in 2022. Indeed, sentiment has been so poor of late, that we saw the S&P 500 index record seven straight weekly falls to Friday, the 20th May – flirting with 20% bear market territory along the way – whilst the more technology-oriented NASDAQ index fell 30% between November 2021 and May 2022 (-29.85% between 19th November and 24th May).

Is this another correction or the beginning of a bear market?

Investors are naturally asking themselves if this is another correction along the way or the beginning of a secular bear market leading to a widespread and far-reaching repricing of risk assets. We believe the former is the more likely and will set out the reasons why in the rest of this note.

Cutting through the noise surrounding markets – and we hesitate to use the term noise in the context of the war in Ukraine or COVID-19 and do so in the statistical sense only – investors are focusing on whether economies, and particularly the US, will avoid a recession as the authorities tighten monetary policy. Economic ‘hard’ or ‘soft’ landings have vastly different implications for market returns as illustrated by the following graphic from Oxford Economics showing US stock and bond returns in different growth environments as demarcated by the National Bureau of Economic Research, the doyen of the business cycle:

Source: Oxford Economics/Refinitiv Datastream

Source: Oxford Economics/Refinitiv Datastream

If the Fed can bring inflation under control and avoid a recession, US equities face the prospect of ‘low inflation/low growth’ – the scenario under which they average the highest returns of the business cycle. If the Fed fails, and the economy succumbs to ’stagflation’, that toxic blend of recession and high inflation, equities face significant further falls and the lowest average returns of the business cycle. It is the tension between these two outcomes that is generating the current volatility as the market continuously reassesses the likelihood of each occurring.

So why do we believe that the US will avoid a recession in 2022/2023?

So why do we believe that the US will avoid a recession in 2022/2023? Well, and at the risk of being a hostage to fortune:

- Inflation should reduce significantly by the year-end with the headline Personal Consumer Expenditures index (the index watched by the Fed) moderating to 4.6%. Food and Energy prices should be close to their peaks and should fall on any reasonable timeframe

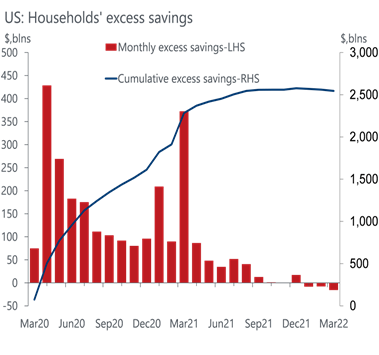

- 3 ‘hangovers’ of the COVID-induced recession should help: labour participation rates in the US are still below their pre-pandemic peak as workers fail to return to the workforce meaning that the labour market is not as tight as at previous cycle-ends; supply chain stresses caused by the virus are still easing; and household balance sheets are still flush with cash from the pandemic stimulus as can be seen in the following chart of US Household’s excess savings:

Source: Oxford Economics

Source: Oxford Economics

- The pressure on goods prices is easing as consumers switch their preferences to services which are less susceptible to short-term trends.

- Although the Fed is very hawkish at the moment, and have made it clear that they will err on the side of tightening, this seems to us part of the normal language of central banks at this stage in the cycle. Given that confidence is a large part of the game, they are obliged to appear very committed as they raise rates. Their language will surely moderate as the pressure on prices eases and markets will probably find that they have priced in too much tightening.

We thus feel that a transition to a ‘low growth/low inflation’ is still the order of the day with its concomitant implications for equity prices. That said, volatility will stay high in the short-term as the market works out, in real-time, the likely outcome of the current tightening for the US and global economies and, consequently, perhaps now, more than ever, is the time for careful active management.