Insights

ESG Innovation is key to solving our sustainability challenges

ESG Innovation is racing ahead, focusing on solving many of the key problems facing the world while recently providing handsome returns for investors seeking out these opportunities.

Whilst much attention has been placed on the obvious solutions in electric vehicles and clean energy, some of the most exciting new areas for investment are working across a much wider range of challenges.

published with permission: Credit Suisse

published with permission: Credit Suisse

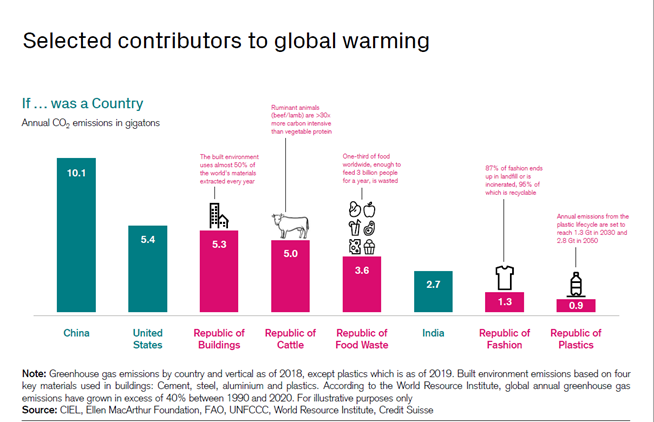

The chart above, produced by Credit Suisse sets out the scale of the challenges, comparing carbon intensive industrial areas with the annual CO2 emissions of the most polluting countries. While, unsurprisingly, China and the US lead the pack, close behind are the emissions of buildings, cattle and food waste, followed by India, then fashion and plastics.

The good news is that entrepreneurs are rapidly building and scaling ways to solve these problems.

There is an increasing range of ways in which investors can participate in these areas, including specialist thematic funds, venture capital vehicles, as well as direct investments.

Thematic funds tackle a specific area of sustainable-related themes. For example, to solve the challenge of high buildings emissions, Smart City thematic funds seek to identify and participate in the success of companies building better-connected, more sustainable cities, with carbon zero targets built into materials, new mobility solutions, infrastructure, and resource management systems.

Venture capital funds (VC) are looking at earlier stage investment, which are more risky and typically need considerable investment before they are ready to make profits. VC’s often invest alongside Family Offices and Sovereign Wealth Funds. The disadvantage to VC funds is that they are rarely accessible to the retail investor. At IAM Advisory, we have seen an increase in new funds targeting ESG innovation whilst offering potential outsized returns if the shift in consumer behaviour continues to favour options that are healthier for themselves and for the environment. Cattle and food waste emissions are linked problems being tackled by the synthetic biology food companies, such as Impossible Foods, which produces a replacement for meat that has the sensation and taste of real beef and plant-based milk companies, such as Oatly, which makes oat-based milk. Both companies remain private for now, with Oatly exploring a public offering.

Direct equity investments can be made either via Angel investing at a very early stage, or once shares go onto the public market. As an angel investor, I have seen some fascinating ideas such as plastic replacement technologies or the use of gravity in old mine shafts, as a type of battery. The stock market is increasingly seeing sustainable companies list their shares. Many will have heard of Tesla’s extraordinary price climb which reflects not just their successful electric car offering, but its vision for sustainable self-driving cars. Beyond Meat, another meat replacement company, has soared since it offered shares to the public in 2019.

Given this enthusiasm for all thing sustainable, it might be worth asking if these investments are building up to be the next tech bubble?

Savvy investors would say ESG innovation is just the next phase in our technological transformation, using technology and science to tackle the many challenges posed by the “Republics” of Buildings, Cattle, Food Waste, Fashion and Plastic. Impossible Foods has over 100 PhD’s working on perfecting their products, including materials scientists working with experts in biopolymers, sensory and perception, biochemistry and flavours. Across a wide range of industries, sustainable innovators have the capacity to disrupt existing product lines, improve user satisfaction and wellbeing, and scale quickly. Beyond Meat is not valued on the current tiny proportion of the market it holds, but on its value if they can take 10-20% of the massive global market for meat. The potential in many of these ideas remains significant and for the enthusiasts is not reflected in current pricing.

Just like Amazon took 10 years to make a profit, because it focused on growth, ploughing income into investment rather than profits, these innovators will continue to invest in their products, refine their customer experience, and those that have successfully captured these changing trends and demands will ultimately reap the benefit. Investors are happy to keep funding these loss-making companies to support their growth at scale. As investors we should take comfort that these companies are targeting high valuations, as their innovations will help address the massive scale of our problems with the urgency required to find solutions to current environmental problems whilst still aiming for outsize returns.

Our environmental problems cannot be solved solely with new innovations, but if, and when government regulations evolve to push companies to do less harm, companies which have already embraced ESG issues will be ahead of the pack.