Insights

Tech Travails

The recent sharp correction in US Treasury bonds and the knock-on falls in the share prices of growth stocks in general, and technology stocks, in particular, remind us all of the fragilities of bull markets.

Inevitably, investors have been left wondering whether the falls were a harbinger of worse to come, or just a wobble on the ‘wall of worry’ traditionally climbed by established bull markets.

Even before the promise that most US taxpayers would receive a $1,400 cheque as part of the Biden administration’s stimulus measures, there had been a growing consensus that the US economy might enjoy a strong recovery from lockdown. The vaccination programme, after all, was being rolled-out with impressive speed. Those with secure jobs through the pandemic had built up unprecedented cash savings – more than $1trn – that stood to be deployed once the lockdown was eased. US companies were tending to report better-than-expected results and most analysts were busy upgrading their forecasts. Add in the clear focus on encouraging consumer spending by the new administration, a growing readiness by the Federal Reserve Bank to tolerate some price inflation as a function of their recent move to average rate targeting and the increasingly bullish forecasts for the US economy from the OECD – now forecasting 6.5% growth in 2021 – and it is hardly surprising that investors are beginning to worry about a resurgence in inflation.

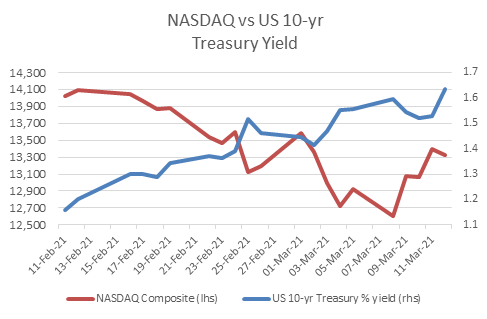

The result was a sudden spike in long-term interest rates as represented by the yield on US Treasuries and a downwards re-rating of growth stocks. Figure 1 shows the yield on the benchmark 10-year US Treasury against the performance of the NASDAQ composite for the period 11 February to 12 March:

Figure 1: The NASDAQ Composite vs the yield on the 10-yr US Treasury, 11 Feb 2021 to 12 Mar 2021

Figure 1: The NASDAQ Composite vs the yield on the 10-yr US Treasury, 11 Feb 2021 to 12 Mar 2021

The fall in the NASDAQ to its nadir on the 8th March was over 10% making it a genuine ‘correction’. It was worse for the technology behemoths – the New York Stock Exchange’s FANG+ index falling 16.6% over the same period, almost putting it in to bear market territory.

So, why were growth stocks particularly affected? Simply because most valuation models make assumptions about the future course of interest rates. Low rates persisting into the future make long duration assets – ones where much of the return is to be realised in the long-term – more valuable. Switch it round though, with higher inflation, and investors begin to prefer assets that offer returns on much shorter time frames. It is the flip side of the arguments that drove ratings higher in the first place.

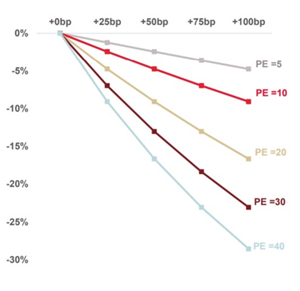

Surfing the internet, I came across an interesting graph the other day where Société Générale analysts show the theoretical impact of rising bond yields on stock valuations at different ratings. Bear in mind that, by some estimates, the NASDAQ is currently trading at over 30x earnings.

Figure 2: The impact of rising bond yields on share prices at different price-to-equity ratios

Source: SG Cross Asset Research/Equity Strategy as shown on marketwatch.com. Note that analysis assumes constant earnings yield ratio minus bond yield spread

So, is it time to exit our highly-rated growth stocks and move into cyclicals and value plays?

Notwithstanding that some diversification is always sensible, be it by geography, market capitalisation, theme or style etc., it is still a very difficult question to answer and takes us back to the ‘wall of worry’ of our first paragraph. The current bull market will come to an end when investors are no longer willing to buy shares on overblown ratings.

Given the low growth/low interest rate environment of recent years, an inflation scare is a likely mechanism and will, no doubt, cause a few wobbles along the way, but it still seems to us too early to be overly concerned.

Why do we say that? Well: it is purely a US problem at the moment – it is hard to imagine economists in, say, the UK and Eurozone worrying about too strong a post-pandemic recovery; the lockdown has brought forward a lot of technological spending which in the normal way should feed through to improvements in productivity; many of the factors that helped suppress inflation in the first instance are still in place – the triad of demography, technology and globalisation; growth in corporate earnings should remain strong over the next two years at least, with many forecasts being upgraded for 2021 and 2022; and a significant part of the pressure on prices in the US should be temporary and will ease as support measures are removed and comparisons with weak prices 12 months ago no longer apply.