Insights

Key Themes for 2024

The IAM Team look at the key investment manager themes of 2024 in a world of change.

It is that time of the year to consider the varied and various views of the major investment house on the outlook for the coming year. As usual, we will make some of the best of these available to our professional clients via our portal. For this IAM Investment Insight, we present some of the common themes and their possible investment implications for the rest of 2024.

Interest Rates

In 2023, many in the market were focused on the impact of inflation and the new paradigm of living with inflation with disagreements over the pace of inflation decline. In the event, as Royal London Asset Management (RLAM) notes, the world economy was much more resilient to higher interest rates than anyone expected. The US and other developed economies have experienced substantial declines in inflation vs peak levels.

In 2024, most Managers think rates have peaked, but there are disagreements on when, and whether, they will come down. The nuance is particularly important in this area. Goldman Sachs Asset Management (GSAM) notes “Living with Higher for Longer” as a key theme for the year, with rates across advanced economies staying “close to present levels throughout most of the year.” Their view is that the Fed will wait “until economic growth slows substantially” to cut rates. T Rowe Price agrees that while the Fed and others have made progress against inflation and policy rates appear close to their peaks, “the Fed is likely to hold rates steady for 2024”. However, Jupiter notes that signs of fragility are emerging in the global economy, particularly in developed countries, which could prompt central banks to be less hawkish.“ They point out these reasons “include the long and variable lags of monetary policy which look to be even longer this cycle, a contraction in lending activity and tightening in lending standards and less support for consumption.”

The nuance is particularly important in this area.

JP Morgan believes rates “could be set to fall later than the market thinks, but may fall further than predicted.” Hence, investors “should focus on locking in yields currently on offer” and in equities, pressure on margins “warrants focus on quality and income.”

Black Rock notes that “higher rates and greater volatility define the new regime”. Increased production constraints and central banks’ limits on fighting inflation leads to a wider set of outcomes, creating greater uncertainty for central banks and investors.

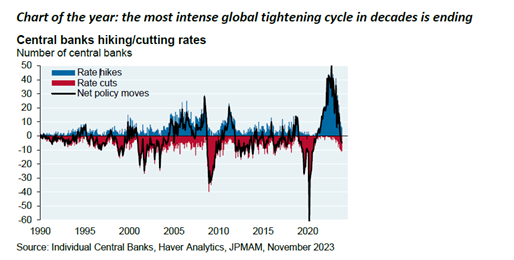

Rate hikes and cuts

JP Morgan Asset Management

JP Morgan Asset Management

Aviva cautions the impact of the interventionist and industrial policy programs such as the US Inflation Reduction Act and CHIPS Act, China’s Dual circulation” policy and European and Japanese initiatives. “The longevity of these policies may also create inflationary tailwinds for many years, supporting higher neutral interest rates. These policies also come with significant fiscal cost that must be managed to ensure long-term sustainability.” As a consequence, a number of managers are beginning to focus on increasing fiscal deficits and governments’ ability to finance these as a global risk with the inevitable increase in bond supply and pressure on rates. Disappointment in the timing and degree on interest rate movements is the major risk for the markets as there is a degree of hubris in this area.

Geopolitics and the 2024 Election Super Cycle

Geopolitical tensions from conflicts in Ukraine and Gaza are further raised by over half of the globe’s population going to the polls this year at all levels of government in over 60 countries. While the US and UK elections later this year are well publicised, Taiwan’s recent pro-independence poll winner may prove just as impactful to further geopolitical concerns. South Africa, India and Russia also go to the polls. However, JP Morgan notes “in the long run, there is no clear correlation between governing party and market performance” and that large deficits in US and UK “limit the prospects of fiscal giveaways”.

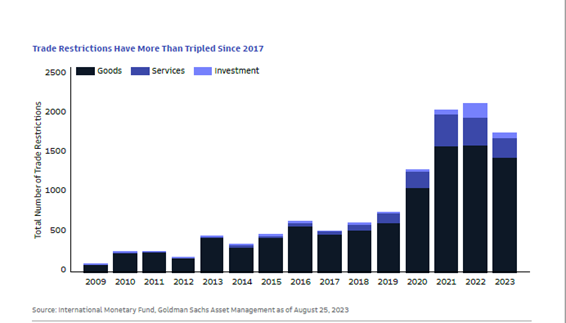

Attention on managing these global risks is key, with GSAM noting “A packed election calendar and geopolitical instability require a focus on both domestic developments and global events. In the US, concerns over government debt sustainability and the fiscal path forward may build in the run-up” to US elections. Further concerns for GSAM include “Socioeconomic risks across countries such as worker strikes by workers demanding higher wages” may pressure inflation, dragging growth. They also highlight risks of more trade restrictions and disrupted supply chains.

Attention on managing these global risks is key

Black Rock identifies global geopolitical fragmentation and economic competition as one of its five Mega forces driving returns, where they are taking on deliberate portfolio risk.

Trade Restriction Increases

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

Aviva terms this as “financial fragmentation”, noting increasing G7 coordination “based on diversifying and deepening partnerships and de-risking, not de-coupling.” This translates to “increased bilateral trade, investment and security deals between G7 economies and their close allies” particularly with supply chain commitments. “Much of this geopolitical tension and related fragmentation relates to the relationship between the US and its allies, and China and its allies.”

Global Markets

Despite these raised geopolitical risks, careful analysis of global markets does reveal opportunities. GAM note that Emerging Markets are “still under-loved, under-owned and undervalued, more so than at any time in the past decade.” Market fundamentals such as cheap valuations, large demographic dividends and GDP per capita gains mean that they are “unlikely to underperform the developed world, and likely to exhibit good relative upside performance in USD”. The “wild card for disruptive growth will be China where valuations are low” while JP Morgan notes the consequences of the Taiwan election results, on a number of levels, will be a key element for investors to watch.

GSAM agree that “Global diversification may also add value to the portfolios as economies diverge and move at their own pace.”

Active Fund Management and key investment themes

Black Rock notes “Those companies that can manage the macro risks of new era will be rewarded. There will be greater volatility and dispersion of returns, rewarding active managers and careful selection.” Another of their mega forces driving this is digital disruption and AI investment themes. GAM agrees “it is a bottom-up stock pickers’ market for 2024” with a base case that “growth equities will remain robust but that the winners will come from below the M7 names with AI, healthcare, storage and SaaS themes driving the best returns.” GSAM agrees there is a need to think differently on portfolio construction, stating “We believe finding the next generation of winners on the right side of disruptive technology and sustainability will require investors to be nimble and look beyond benchmarks.” In particular, they note “the new realities of higher interest rates and geopolitical risk call for less leverage and more attention to liquidity and risk management.”

GAM also notes the increasing impact of regulation in the sustainability space, with incoming mandates for companies and funds for sustainability disclosure and labelling required or soon to be required by the EU, FCA and SEC. This will support the increasing numbers of investors including sustainability considerations in their approach. As noted by GSAM, “The use of more complete metrics is also likely to expand in 2024 as investors seek to properly quantify the real-world impact of individual assets.” Several note the importance to monitor the impact of climate policy, in particular the US Inflation Reduction Act clean-energy incentives, and those of other governments planning similar initiatives to speed the energy transition.

Those companies that can manage the macro risks of new era will be rewarded

RLAM have consistently noted that while the macro-outlook for the economy and markets is unclear, the micro-outlook for industries and companies is much more certain. “There are many definable societal and investment trends which we believe will occur regardless of whatever path interest rates, inflation and the economic cycle take.” They identify these as digitisation, decarbonisation ad healthcare outcomes.

A final word to RLAM “Perhaps the only certainty for 2024 is it will turn out differently to how we expect. … One thing is for sure though, it won’t be dull!”.

IAM Advisory is a strong believer in the opportunities of active fund managers to deliver superior, risk-adjusted returns when instructed and structured correctly. 2024 seems to be a particularly important year to invest actively. If you would like to find out more about how we manage fund managers, please get in touch.