Insights

Key Investment Themes for 2026

The IAM Team summarise the key investment manager themes for 2026 in a world keeping an eye on inflation, AI and geopolitics with a surprisingly optimistic consensus for growth and favourable investment opportunities.

Looking at a diverse range of investment manager 2026 Outlooks, there is a sanguinity to the risks, with Royal London Asset Management noting that almost every concern an investor could have had at the start of 2025 came true, geopolitical uncertainty, high volatility, but “markets have not increased their risk premia – indeed, in many cases these are now lower.”

Economy and Markets

Such is the magnitude of AI spending that every Outlook considered how deeply intertwined AI spending and opportunities are with the economy.

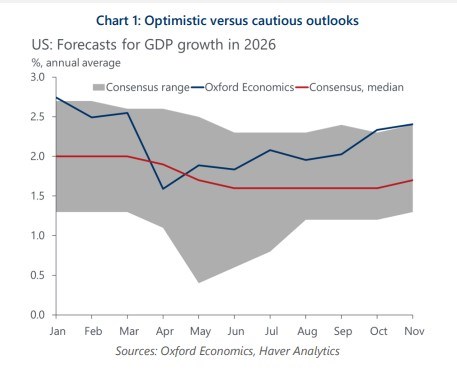

Oxford Economics expects the US economy to “outperform consensus expectation, supported by wealth effects, AI- and non-AI related business equipment spending, and solid productivity growth… the economy will reap the benefits of increased AI spending.”

According to UBS “AI and technology have been and should continue to be key drivers of global equity markets. Expect global economic growth to stay resilient and accelerate through the year.”

Robeco was similarly upbeat, stating we are in “a rare short-lived synchronized late-cycle upswing, driven by easing trade tensions and uptick in the global manufacturing cycle and lagged effects of global central bank easing.”

"Going into 2026, the backdrop should be supportive for global growth" Pictet

Pictet noted we are “Past peak trade uncertainty, Supportive monetary policy, broad-based fiscal stimulus. Going into 2026, the backdrop should be supportive for global growth.”

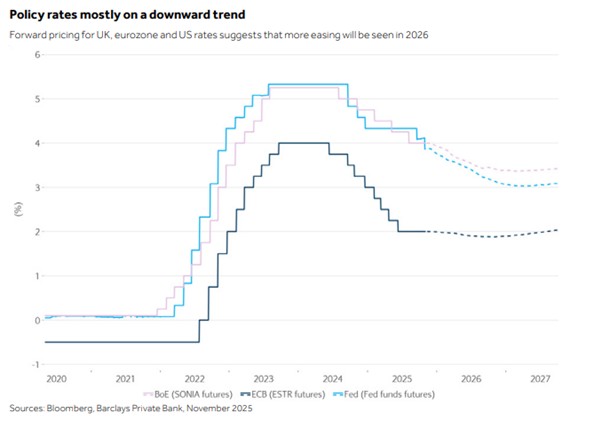

While inflation was noted as a potential risk, most felt it would be muted, with Robeco noting that “it will take time for a second inflation wave to develop. We expect more Fed cuts (75bp towards the end of 2026).” Looking outside the US, they believe “developed market inflation will remain above target but will crucially not exceed 4% in 2026,” providing a “sweet spot for harvesting strong real equity returns, assuming no US recession materialises”. However, JP Morgan notes the unknowns surrounding inflation are one of their “three powerful forces that will shape 2026.”

Managers noted a few areas of risk, including Barclays who stated they continue to be concerned about “tougher tariffs, ballooning government debt, and the AI frenzy. As if this weren’t enough, investors face a long, tense and tight midterms race until it concludes in November…Key market risks for 2026 are concentration risk and AI. Investors should prepare for greater dispersion both within and across markets.”

UBS is concerned that “we could face a period of softness for the US economy” noting “reduced labor supply and more cautious hiring”. They expect inflation to “peak in the second quarter at just over 3%.”

Several managers noted the US ‘K economy’ and its impact on consumers. Barclays states “the wealthiest 20% of households in the US now account for roughly two-thirds of all personal expenditure. Those lower down the income ladder have been struggling for some time. This so called K-shaped economy isn’t sustainable.” Yet Robeco feels the “expansive fiscal policy in US is helping lower-income households to recover.”

Market trends

AI and Technology - impact on jobs and productivity

For UBS, key for their analysis of AI’s impact in 2026 will be “rising levels of capex, given its vast revenue potential, and whether and how much AI can be monetized.”

Royal London Asset Management believes “the fate of AI will very much continue to dictate the performance of the world’s stock markets and corporate behaviour in the coming year.”

Oxford goes further noting the “economy will reap the benefits of increased AI spending, but wide corporate profit margins and investment incentives under the One Big Beautiful Bill Act, including full expensing for new equipment and immediate expensing of domestic R&D point to increased equipment investment outside of AI.”

Robeco question “are we seeing the beginnings of broader, AI-driven productivity growth or are employers holding off on hiring, pushing their workforce harder to squeeze out more efficiency gains amid prevailing trade uncertainty?” In their view we are “already seeing some glimpses of accelerating productivity growth.”

As 2026 nears, the AI theme remains powerful, but its dominance has introduced fragility.

Barclays highlights that AI’s “ability to enhance productivity and profitability across various industries keeps us optimistic about the future. However, this technological revolution promises to be gradual and non-linear, possibly triggering significant rotations.”

As 2026 nears, the AI theme remains powerful, but its dominance has introduced fragility. Barclays notes "The year ahead is likely to mark a transition from momentum to moderation, where fundamentals and diversification regain the upper hand.”

Resilience

Royal London Asset Management believes “one of the reasons for the … rise in markets has been a growing faith that companies can take these challenges in their stride and will prove more resilient than investors had been giving them credit for. This marks a distinct change in focus. Efficiency was once the holy grail of corporate strategy… Today, resilience commands the premium…. The question has shifted from “How lean can you be?” to “How shock-proof is your business model?”.”

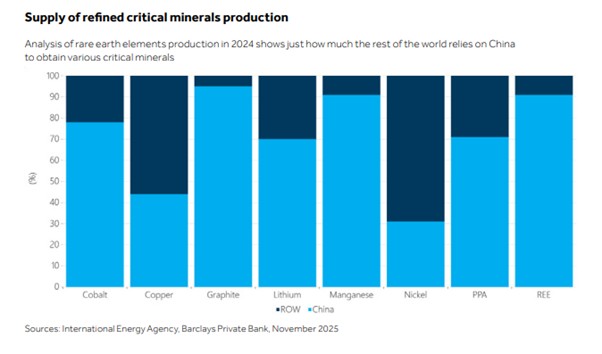

In a similar vein, supply chains were also highlighted by some. JP Morgan identified another of its three powerful forces shaping 2026 as Fragmentation, being ”a splintering into globally competing blocs and contested supply chains”, which is “remaking the global order and requiring greater attention to resilience and security. Think fragmentation not globalization. A reconfigured economy prioritizes resilience over efficiency. Identify opportunities where security, energy and supply chains converge.”

Global market view

Oxford Economics highlights US-China trade relations, “as the world’s two largest economies strike a delicate balance in their efforts to decouple from one another in the least economically disruptive manner possible.”

Robeco believes China and to a lesser extent Europe “has more room for non-inflationary growth compared to the US”. In China, “while there are subdued activity levels, the second half of 2026 may see more promising signs of higher domestic consumption as the housing market deleveraging cycle reaches its final phase against a backdrop of stronger domestic fiscal stimulus.

“China’s tech sector stands out as a top global opportunity.” UBS

In particular, UBS says “China’s tech sector stands out as a top global opportunity.” But Barclays thinks China broadly “needs to gradually move up the value chain, focusing on more advanced technological manufacturing, while building new trade partnerships.”

Robeco believes that “other developed markets include Germany and Japan showing accelerating real activity from a strong base, driven by the lagged impact of past ECB easing, spending of excess household savings and recovery of export demand. A stronger Euro poses headwinds to external competitiveness, but fiscal multiplier effects from defense and infrastructure-related expenditures strengthen internal competitiveness.”

Similarly, Barclays note that they “expect other nations to shine in 2026. The eurozone in particular could surprise positively. Similarly, the UK could finally move out of first gear.” But “We expect 2026 to be another challenging year for the eurozone, as well-known obstacles mask some positive German developments that may not bear fruit until later in the decade. For medium-to-long-term investors, the strategy remains the same: stay selective.”

Finally, Robeco is not alone in seeing opportunities in emerging markets, noting “an additional weakening of the trade-weighted dollar could see emerging market equities accelerating versus developed market counterparts. …. Consensus expectations of China outperforming the rest of EM in 2026 are also subdued, making this a more contrarian trade.”

Bond market

There is positivity on bonds as well. For Barclays, “the outlook for bonds in 2026 remains broadly constructive. Yields are well above their 20-year averages, providing a strong starting point for performance.” Key macro drivers which should support the bond market in 2026 include: anemic growth in developed economies, moderating inflation, lower policy rates and healthy private sector balance sheets.”

Metals

Managers noted generally positive conditions for gold and industrial metals.

Robeco notes that in light of a synchronized cyclical upswing, they think that industrial metals have room to rally “once the global manufacturing cycle starts to improve”. They emphasise that “The US administration is now proactively reshaping supply chains away from China and promoting domestic manufacturing in sectors deemed critical to national security.“

According to UBS, Industrial metals could start to “outperform gold once the global manufacturing cycle starts to improve.”

Sustainability

Despite a record USD 2.1trn investment in the energy transition in 2024, only UBS mentioned opportunities in sustainable investing, noting trends are “expanding the universe of investable asset classes…. even as political debate around sustainability continues.”

IAM Advisory is here to help you

Get in touch

IAM Advisory provides more detailed, up-to-date analysis of markets for its clients as part of its comprehensive monthly reporting. If you would like to find out more about our services, please contact Michael Strachan or Simon Bowden.