Insights

Investment outlook 2025

The IAM Team summarise the key investment manager themes of 2025 in a world keeping an eye on inflation, Donald Trump and tech with diversification being essential.

US election impact on the economy

There is a strong consensus that the Trump policy agenda will support growth, but there is also consensus that the fiscal stimulus, proposed tariffs and immigration curbs might combine to create more inflation than real growth. While Goldman Sachs expects limited tariffs (auto and China) will lead to 2.5% US growth in 2025, most analysts are in the 1.5%-2.5% range according to Bloomberg.

Many analysts note that inflation will in turn restrict the Fed’s space to ease interest rates. The unpredictability of Trump’s upcoming regime gives traditional financial analysis of economic indicators more than usual room for surprise.

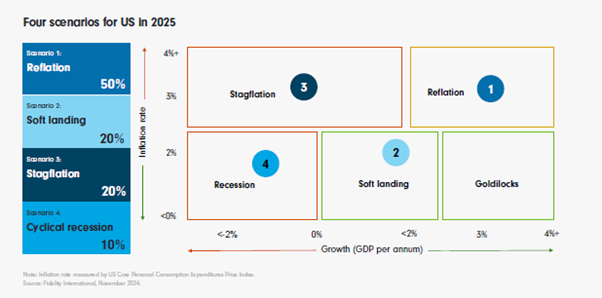

These policies matter more than for just America, as JP Morgan noted “A renewed focus on ‘America first’ policies will require responses from other regions, notably Europe and China, where large scale monetary and/or fiscal stimulus is expected.” US inflation “could slow the pace of disinflation more broadly and in Emerging Markets – also slowing monetary easing” according to AXA, though they expect some divergence across the world’s main economic regions. Fidelity notes the election “raises the odds of an outright reflation of the world’s biggest economy compared to expectations of a US soft-landing scenario which was the 2024 base case. We are mid to late cycle, and not end of cycle, creating a volatile environment that should generally be good for risk assets but puts a premium on getting investment choices right.”

Global growth rates (2.6-2.7%), with Goldman Sachs noting “a key reason for optimism on global growth is the dramatic inflation decline over the past two years.”

Some researchers note the economy being in an unconventional phase of cycle, with Amundi seeing “a positive outlook alongside anomalies like market concentration and excessive debt levels. While global macro liquidity supports riskier assets, growing policy uncertainty and geopolitical tensions highlight the need for greater diversification.

Source: Fidelity

Source: Fidelity

Equities

Fidelity expects that “reflation will boost earnings, easing fears over higher corporate valuations. A probusiness, pro-innovation administration should prove helpful and lower interest rates should benefit capital-intensive industries and help cyclicals outperform. Optimism prevails in Japan and India.”

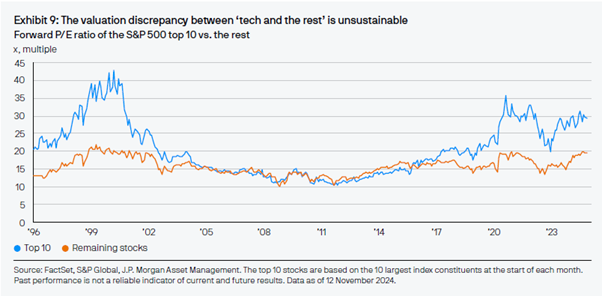

However, Mirabaud believes US PE ratios mean valuations are stretched. “For 2025, it is currently expected to be higher than this (12%), which means actual earnings growth needs to be even higher still for stocks to continue their ascent.

However, this is not true of all the market. There are some areas where the risk/reward ratio is much more attractive. On an equally weighted basis, the US market is much less expensive, and earnings upside is potentially higher. This suggests we can move away from mega caps. Our focus for 2025 will be on identifying better risk/reward dynamics in high-quality companies trading at more reasonable valuations.”

Goldman Sachs is similarly balancing the supportive environment for equities (interest rate cuts coinciding with economic growth) against the high valuations for global equities, which “leave little room for further valuation expansion. We expect index returns to be driven largely by earnings growth.” Hence, they expect to “focus on diversification to improve risk adjusted returns… [preferring] a more eclectic mix of sector and styles with an increase in focus on Alpha relative to Beta.”

"the next stage of the technology evolution will lift asset prices elsewhere in the global stock index"

Technology

There is much focus on how the technology boom will play out. Trump’s approach to cryptocurrencies lends belief to more favourable regulation. However, JP Morgan believes “the best of the tech gains has been had, and as those technologies proliferate around the broader economy, the next stage of the technology evolution will lift asset prices elsewhere in the global stock index.”

Source: JP Morgan

Source: JP Morgan

Diversification

JP Morgan looks forward to “incorporating bonds for income and recession protection, but also assets that will perform well during inflation shocks.”

Amundi expects to look “beyond US mega caps… towards value, pockets of value in Europe and sectoral opportunities such as financials, utilities, communication services, and consumer discretionary. “

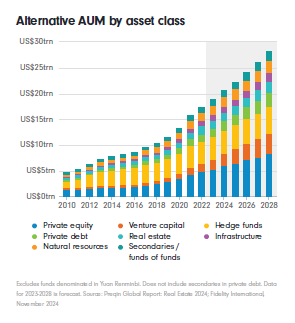

Fidelity “The need for a diversified portfolio to spread risk also makes the case for private assets. Going into 2025, with many markets still on the cusp of recovery, prices are low and there are opportunities for investment that could deliver solid returns in the medium to long-term.”

Source: Fidelity

Source: Fidelity

China

AXA notes China “is in the midst of a real estate correction. Experience accumulated across many such episodes across the globe suggests that slumps in residential investment last years…. counting on a recovery any time soon is illusory” Fidelity concludes there has been a “bumpy pivot to slower, more sustainable model of growth focused on domestic consumption and higher-end manufacturing. What China does on stimulus - and with its stock of US Treasuries - looms large. A stabilising Chinese economy is welcome news for Europe, but it will not lend enough strength to the continent to fully recover in the next 12 months”. Goldman Sachs has reduced its “2025 China GDP forecast to 4.5% because of higher US tariffs that are only partially offset by easier macro policies” noting risks to the downside if tariffs increase beyond its baseline.

Fixed Income

Fixed income is attractive for both diversification and targeted opportunities. Mirabaud agrees with many expecting Trump being good for growth, so on fixed income “we think US high yield will continue to earn its place in fixed income portfolios going into the new year. Although we have seen some signs that the US economy is slowing, they are countered by high levels of consumer confidence and a resilient labour market. An uptick in inflation is not necessarily a bad thing for high yield either, as long as it doesn’t get out of control. “

Amundi believes “The income theme gains traction. As inflation decelerates to long-term average levels, central banks will continue to shift towards more accommodative policy stances. The gradual return to neutral monetary policies, combined with low recession probabilities, will emphasise bonds’ income-generating function, with relatively higher yields compared to the past. Opportunities are appealing in Investment Grade and short maturity High Yield credit, leveraged loans, EM bonds and private debt.”

However, Fidelity notes with public sector deficits projected to expand, the prospect of tariffs and trade disputes, and ongoing geopolitical tension, there is a case that less optimistic scenarios are being underpriced. This represents a potential source of value in credit markets.

Investors are looking for ways to capitalize on the energy transition. Private markets may have the solutions.

Sustainability

Most investment manager Outlooks focus on the large economic picture, and it is notable that despite 2024 record-breaking statistics, climate disasters and their increasing cost, sustainability and climate risk events rarely figure in these analyses. However, MSCI research published some core trends in sustainability driving change in 2025. Amongst these they note a “Climate reality check - Extreme-weather events in 2024 emphasize climate risk and the need for investors to prioritize resilience and adaptation across their portfolios.” And “Private capital’s energy-transition advantage - Investors are looking for ways to capitalize on the energy transition. Private markets may have the solutions.”

Contact us

IAM Advisory provides more detailed, up to date analysis of markets for its clients as part of its comprehensive monthly reporting. If you would like to find out more about our services, please contact Michael Strachan or Simon Bowden.