Insights

Importance of getting investment structure right

Getting the Investment Structure right is essential for a successful investment portfolio. We outline the risks of too simple and static an investment structure.

The investment structure is how you delegate investment discretion to fund managers and funds within a total client portfolio. IAM Advisory believes that getting the investment structure right, at the outset, is a key determinant of a successful and dynamic portfolio. We devote considerable attention to avoiding the risks of too simple an investment structure, ensuring our clients get the best from their investment managers

The investment structure decision is often confused with asset allocation – asset allocation is the outcome. Using multi-strategy managers portfolios to achieve a subsequent asset allocation means paying fees for decisions you then override, centrally.

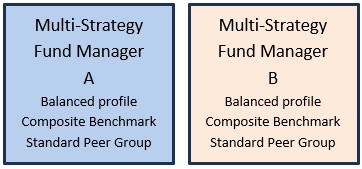

Furthermore, the delegation of investment powers by fiduciaries is far too often distilled down to choosing a few discretionary fund managers and their ‘flagship’ or ‘medium risk’ strategy. These would typically, have a similar target return and risk profile. There is probably a similar “composite benchmark” or peer group used as the basis for selection and against which their performance is judged. We would contend that few clients actually have a ‘balanced’ profile there is a need for a more granular, nuanced, flexible and bespoke approach.

A Typical Investment Structure

This type of approach is understandably attractive for the trustee/owner, as it makes for ease of administration and ongoing performance comparison. The problem for the trustee, in the use of such a simple structure, is that there are a number of risks which mean that the trustee or owner are unknowingly making the key decisions on the portfolio, not the manager. They have neither effectively delegated away discretion nor effectively met the primary fiduciary responsibility for diversification

Risks of the Standard Investment Structure

We discuss below the risks involved in the typical investment structure, of just hiring two or three managers, for fiduciaries and their clients.

Diversification depends on the mandate

The diversification benefit of employing more than one fund manager is well understood, helping to reduce not only the decision-making risk of one manager underperforming the wider market but also, the institutional risk (think Barings) and key man risk (think Woodford). Nevertheless, one should not be surprised that setting the same mandate for a limited number of managers also leads to similar risk and return outcomes. Most investment teams analyse companies and markets using well established methodologies, learnt whilst studying the same professional qualifications, all of which leads to the emergence of the consensus view and considerable duplication. In addition, institutional rigidities, such as the focus on their own corporate risk profile and thus not deviating too far away from the strategic benchmark or the peer group, will also restrict effective active management and will lead ultimately to a lack of diversification and consequent increase in risk. This can be avoided by introducing a wider range of more specialist and properly active fund managers.

Limited delegation by the fiduciary

The typical structure means that the mandate at the level of the individual manager and the consolidated total portfolio will generally operate under relatively tight asset and currency ranges, which means the fiduciary is effectively making the asset allocation and currency decisions themselves through the managers and mandates they have selected.

Reduced dynamic

Setting similar or the same mandate instructions to the managers reduces flexibility of the total portfolio. Whilst enabling easy performance comparisons, interpretation of results is difficult and can lead to decisions to reallocate funds between managers at arguably the wrong times, with past performance often incorrectly rewarded. This can be avoided by ensuring each fund manager has a specific but differentiated role to play in the overall risk profile of the portfolio.

Risk control issues

The lack of diversification and dynamism introduces particular and unappreciated risks with increased and unexpected correlations.

Misses benefits of specialists

No advantage is taken of investment specialists - the increasing importance of employing specialists, which can be a mixture of specialist strategies in multi-strategy portfolios and in individual asset classes, geographies, sectors, investment themes, ESG etc. Evidence has suggested that no one manager is good in all investment areas.

How to get the investment structure right and avoid the risks of over-simplification?

IAM puts great value in taking time at the outset to ensure the investment structure is fit for purpose, ensuring diversification, dynamism, and proper delegation of investment decisions to investment managers.

The IAM Approach leads to a more diversified and dynamic investment structure

IAM works closely with specialist fund managers to identify the best in class of each of these other strategies. At the outset, what might seem relatively simple questions are asked but when combined, provide the basis for a more interesting structure.

Questions such as,

• who to use?

• how many to use?

• their mandates?

• how much to allocate?

• the investment approach i.e. individual position, funds or a mixture

• how do they fit alongside other assets?

• how much should you pay them?

• how do you ensure they are doing a good job?

• when to change allocations?

• when to hire and fire?

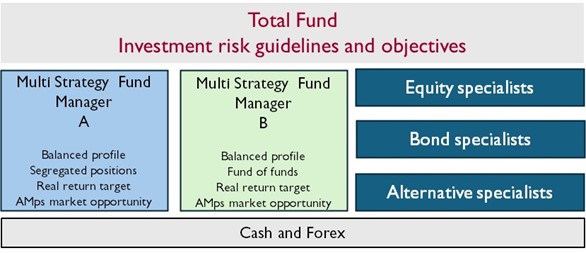

The IAM Approach walks clients through all these questions as part of the initial review which sets the investment policy statement, a strategic framework which is disciplined by setting appropriate risk controlling investment guidelines and consequent investment objectives for the total portfolio. Usually this leads to a more diversified and dynamic investment structure, with the use of a combination of multi-asset DFMs and selective specialist funds employed in a way which encourages flexibility and reduced correlations.

The Dynamic Investment Structure

Rather than two or three identical mandates, the more preferred structure will have similar horizontal and vertical blocks as the one above. We have significant evidence that shows such an approach will enable greater risk and cost control with measurable incremental returns, well in excess of fees. This is achieved, whilst enabling the trustee or owner to meet higher governance standards for fiduciary assets.

If your investment structure needs to be reviewed, please get in touch to see if we can help you establish a successful and dynamic portfolio, reduce your risks, improve client outcomes and more fully meet your regulatory requirements.