Insight

IAM Approach to Private Equity Part Two

In this second part of our investment insights on private equity, Managing Director Michael Strachan outlines the various investment approaches and the current outlook of the PE market

Private equity investment (PE) is a substantial and growing area of the investment markets it is arguably much in vogue and seen as a panacea for difficult and disappointing returns in liquid public markets. IAM have been directly involved in this area for over 40 years. Whilst considered a vital part of modern private client portfolio management it is in our view not properly understood and easily misrepresented. It must be approached with considerable caution. There are selective opportunities, but it is arguably, as a function of current popularity, generally over-priced and overleveraged. In such an environment risk control becomes critical, particularly in how any successful PE strategy interfaces with the rest of a client’s marketable portfolio. PE requires a completely different approach to risk control to conventional approaches for liquid assets.

In our first article, I set out the IAM PE philosophy and approach to this fascinating and complex asset class. I stressed how important that it was through a well-articulated disciplined strategy that linked the assets class with the rest of the client portfolio. This article follows up by presenting the various ways in which the asset class can be accessed and touches on and the general and emerging concerns surrounding PE investment.

As was highlighted in Part One and in common with any asset class, diversification is key, but the nature of this is different from conventional portfolio construction. One element is the structure of the investment. Various entry points are discussed below although almost by definition, as PE is highly bespoke this cannot be exhaustive.

IAM Advisory have experience with and can provide advice and assistance on implementing.

PE Investment Structures

- Direct: This is typically an investment made directly in the equity or debt of a private company. Direct private equity investments carry increased risk due to the need for scale to ensure diversification. They are difficult and costly to manage due to the administrative burden and due diligence requirements. Hence, direct PE investment is usually undertaken by large investors with $100m+ available and with a specialised in-house team. The exception to this is angel investment where much smaller investment are made in a large number of projects. Nevertheless, the same principles of diversification apply.

- Segregated External: A professional external management team is appointed to invest in private equity following a strategy selected by the client. Similar to direct investment, this approach is generally restricted to those who have $100m+ to commit to this asset class. The principal risk of such an approach is the commitment to one PE manager and a further layer of fees.

Limited Partnerships: The client participates in a series of limited private equity partnerships provided by different managers in different strategies. This is the classic approach, unfortunately, in recent years, with the general growth in these areas, the minimum has gone out of reach of many private equity investors being >US10m. It is therefore difficult to create critical mass for diversification. We do have access to smaller more innovative funds with lower minima, which can be of interest and accessible. - Manager operated funds: Many private wealth managers launch private equity funds which pursue a range of single strategies using external managers. These aim to gain benefits of scale for their clients by enabling them to participate in diversified strategies on smaller minimums (down to as low as US$100,000). Such strategies usually involve a further layer of fees and leave the critical decisions with the fund manager or the owner as to which funds to take, there is little diversification by manager unless a portfolio of such funds is established. It leaves some due diligence with the client, albeit at a reduced level.

- Fund of Funds: Private equity fund of funds invest in a number of private partnerships that invest in private equity. The benefit of this structure is that it can provide greater diversification across geography, style, sector, vintage and manager. It also spreads the costs of the intensive due diligence and administrative burden required to effectively choose and select between investments. The main downside is the extra layer of fees charged, which can include entry fees and high management and performance charges. The performance record of such funds has been mixed and vintage year can be critical.

- Quoted Private Equity Management Companies: An interesting alternative to direct investment is investment in PE companies listed on public stock exchanges (such as Blackstone, Carlyle) that generate their income (management fees and carried interest) from managing private equity funds and direct investments. Recently these companies have been badly hit in the general market downturn and indeed might well be harbingers of more difficult time in the asset class. Their track record is difficult to reconcile with the general enthusiasm for the asset class.

- Quoted Private Equity Investment Trusts: These provide a way for investors to gain access to traditional private equity funds that they might otherwise not be able to do directly due to the high minima required.. The downside to investing in quoted funds is that in some cases a significant discount to NAV can occur and persist for long periods. This of course can work to an investor’s advantage in enabling well diversified portfolio to be acquired at a discount. This is what is currently the case and would appear to be attractive. Liquidity can be difficult for larger investors.

- Co-Participation: Sometimes within private equity management agreements the investor has co-participation rights, which offer the opportunity to increase exposure to an existing position within a fund, by making an additional direct investment. Whilst sometime these can be attractive they do present challenges and can easily distort the balance of the overall PE strategy. The client has to undertake their own due diligence.

The current outlook for PE

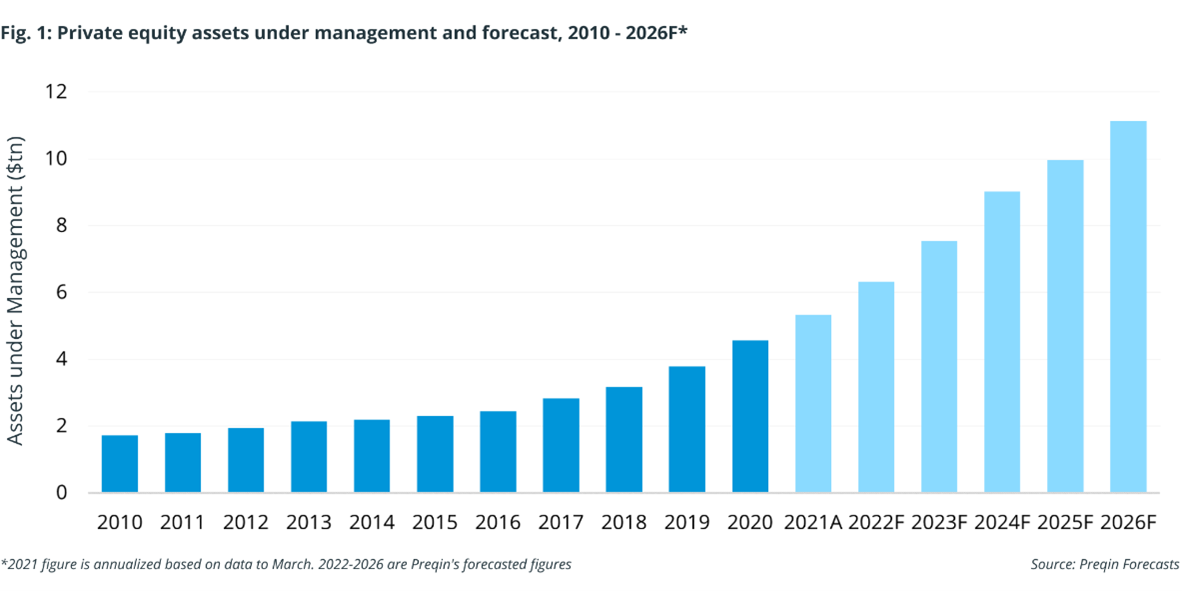

The AUM in PE is expected to rise to US$5-6tr in 5 years as allocations to PE are expected to triple over the next 10 years. The increase is in part due to the increasing tendency to retain companies private for longer and not IPO, as well as the trend for more public companies to become private, often as a consequence of increased public market regulation.

The number of companies with private equity ownership exceeded companies that are owned in public in 2019.

Inevitably, such growth has brought it own particulate problems.

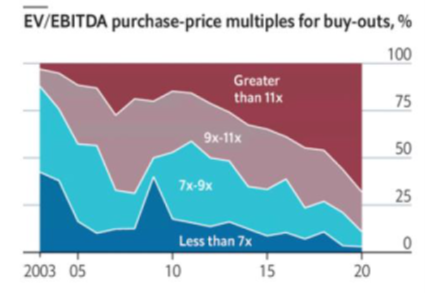

This means there will be substantial “dry powder” looking to invest, with inevitable impact on the valuations as more money chases deals in a more a difficult economic environment. There are estimated to be over 18,000 funds and this means the danger of overpaying with multiples arguably higher than public markets, with no discount for illiquidity. This is of concern. The graph below shows the growth in higher multiples since the financial crisis in 2008.

Source: The Economist/McKinsey

Source: The Economist/McKinsey

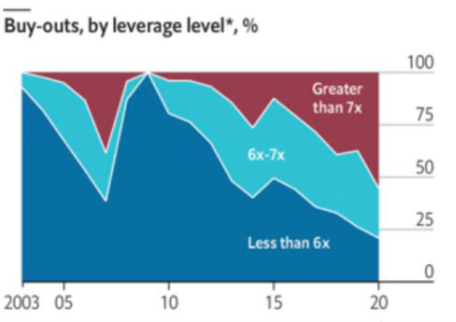

At the same time there has been a significant increase in leverage in some strategies which when combined with over commitment and difficult liquid markets cannot be considered healthy. The graph below shows this accelerating trend.

Source: The Economist/McKinsey

Source: The Economist/McKinsey

The difficulties in the SPAC market shows what can happen once the unbalanced and inequitable nature of the capital structures became apparent it does indicate the dangers involved in what remains a purely regulated asset class.

On the plus side, there has been some improvements with a growing, though still limited, secondary market. This is coupled with changes in government regulation requiring greater transparency on fees and expenses. Inevitably, there has been pushback from the managers.

Another interesting area is the emergence of specific funds with enhanced sustainable investment objectives, where the structure of PE enables a longer-term perspective over which to judge impact.

Conclusion on IAM approach to PE Investment

- Private equity, as an asset class, is an essential element of any modern private client portfolio.

It is essential that PE is invested through a disciplined and well-articulated strategy that is subject to clear rules on diversification by geography, manager, type etc.

Performance figures (IRRs and Multiples) must be treated with considerable caution. They cannot be directly compared with conventional equity returns and need to be risk adjusted.

It is important that this is seen as a long-term strategy with implementation over a period of years (>10). - The PE area is currently generally overpriced in terms of multiples with many strategies relying on leverage to achieve returns with inevitable implications for risk

- Several strategies are not currently attractive for private clients but there are selective areas that are missed by the large investors, not leveraged and reasonable entry multiples

- Any over-commitment, in anticipation of future distribution, must be carefully managed with contingency plans in the event funds are unavailable.

- It is impossible to propose an appropriate allocation, which is entirely client dependent and bespoke, dependent on the character of the liquid portion of the overall portfolio and the client’s risk profile. It can range from 5-10% for smaller portfolios out to over 40% for large endowments.