Insights

The devil’s in the (index) detail

The divergence in returns from major equity market indices can be stark. At least on this front, this year is no exception.

Year to date the S&P 500 is up 5%, while the FTSE 100 is down 24% (both in GBP terms). There can be many idiosyncratic reasons why the fortunes of the companies listed on the stock exchanges in the United States will differ from those on the London Stock Exchange; having an awareness of a portfolio’s exposures is key to successful investing.

The S&P 500 and FTSE 100 are share indices of the largest 500 and 100 companies by market capitalisation, listed on the US and UK stock exchanges, respectively.

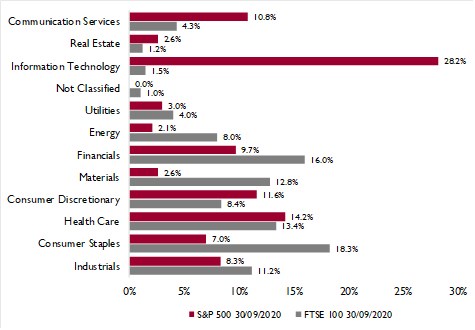

Current S&P 500 and FTSE 100 sector weightings

Source: Bloomberg

The variations in the sector weights of the two indices can go a long way in explaining their relative performance. With the UK market’s higher weighting in energy stocks relative to the US, it is unsurprising that the UK market typically underperforms the US on days which oil prices decline.

Concerns over global growth and the corresponding lower future demand for oil has played its part in marking the UK out as one of the weakest markets worldwide this year. Similarly, information technology being the S&P 500’s largest sector has been the main positive driver of this index’s returns year to date.

Without having an awareness of the composition of an index, investing in an index tracker as part of a passive strategy can result in unintentional active sector bets. Furthermore, as the composition of an index changes with the addition/removal of new companies or as sectors grow relative to others, buy and hold investors of index funds could unknowingly find their portfolio exposures are very different to those they began with.

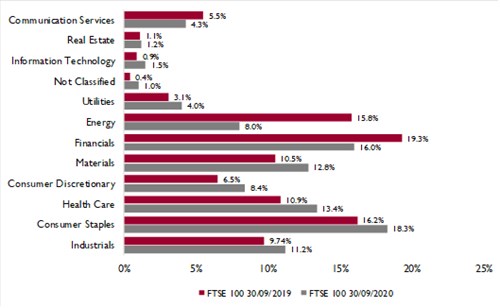

Change in FTSE 100 sector weightings - 2019 to 2020

Source: Bloomberg

The level of damage caused by the global pandemic to financial markets has not been shared equally across all sectors.

It is not difficult to see why the utilities and healthcare sectors are among the best performing sectors of the FTSE 100 year to date, or why the sectors which typically have profits, which move in tandem with the wider economy, such as energy and financials, have been the hardest hit. Through the collective actions of active investors, the FTSE 100 is now more defensive in nature than it was at the beginning of the year. An investor in a FTSE 100 tracker would now have approximately half of what they would have had just 9 months ago, invested in energy companies. Given the current sector weights, an index investment in the FTSE 100 now will likely provide more protection from a future market downturn. However, on the flip side this also means that an investment in the Index will not fully capitalise on the gains from a future economic recovery.

The underlying exposures of a portfolio can change markedly over a relatively short timeframe, even for passive investors. It is essential to be cognizant of these changes and understand their implications, to ensure that each investment remains appropriate for the total investment structure and that there are no unintentional exposures, or indeed gaps.